Should You Stay In-State or Shop for an Out-of-State 529 Plan?

529 plans are among the most effective tools available for education savings. They offer significant tax benefits, both federal and state-level, and allow families to accumulate and withdraw investment gains tax-free when used for qualified education expenses. However, understanding how your home state treats these contributions can help you make a more informed—and more profitable—decision. This article breaks down the types of 529 tax benefits, explains which states are most favorable, and explores whether you should consider going out of state for a better plan.

6/12/20253 min read

At the federal level, all 529 plans offer the same straightforward benefit. Your investments grow tax-deferred, and withdrawals for qualified education expenses are exempt from capital gains taxes. This can be especially powerful for long-term savers.

For example, if a couple contributed consistently and realized $10,000 in gains, federal tax savings could range from $1,500 to $2,000 depending on their income bracket. However, families earning less than $96,700 would not owe federal capital gains tax, so the federal benefit in their case is more about tax deferral than avoidance.

State-Level Tax Benefits

The state-level picture is more nuanced. Depending on where you live, you may be eligible for a:

State income tax deduction

State income tax credit

Tax parity, which allows deductions for any plan, not just your state's

Or no benefit at all

Morningstar’s recent analysis provides a detailed breakdown.

Understanding the Map

The map below categorizes states based on how they handle 529 contributions:

No Benefits: CA, HI, KY, NC

No State Income Tax: AK, FL, NV, NH*, SD, TN, TX, WA*, WY

(*Tax on limited income types only)Tax Deduction: More than 30 states and D.C.

Tax Credit: IN, MN, OR, UT, VT

Tax Parity: AZ, AR, KS, ME, MN, MO, MT, OH, PA

These classifications shape the value of staying in-state versus shopping nationally for a better-rated or lower-fee plan.

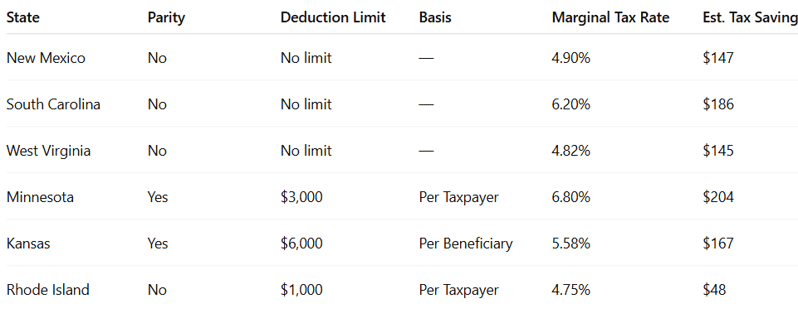

State Tax Deduction Examples

State tax savings depend on your income, your state’s marginal tax rate, and contribution limits. For a married couple earning $100,000 and contributing $3,000 annually, here are some 2025 highlights:

In states with per-beneficiary limits, families with multiple children can deduct far more than the table shows. For example, a $5,000 annual contribution for each of three children could result in deductions up to $15,000 in some states, significantly increasing savings.

State Tax Credit Highlights

Five states offer tax credits rather than deductions. These generally provide better value for lower-income or moderate savers.

Indiana offers the most generous credit: 20 percent of contributions up to $1,500.

Minnesota offers a credit or deduction based on income, with lower-income households receiving up to a $500 credit for just $1,000 contributed.

Oregon adjusts credit percentage by income, offering up to $360 for joint filers contributing $1,440.

Utah and Vermont offer modest credits with relatively low contribution limits.

Tax Parity: Greater Flexibility

Nine states offer tax parity, meaning residents can claim a deduction no matter which state’s plan they use. These are:

Arizona, Arkansas, Kansas, Maine, Minnesota, Missouri, Montana, Ohio, Pennsylvania

This gives investors more flexibility to choose plans based on performance, fees, and investment choices, rather than being locked into their home state’s offering.

529 Plans: Platinum and Gold

If you are considering an out-of-state plan, these are the highest-rated options as of 2025:

Platinum-Rated Plans

AK: T. Rowe Price College Savings Plan

IL: Bright Start Direct-Sold College Savings

MA: U.Fund College Investing Plan

PA: Pennsylvania 529 Investment Plan

UT: my529

Gold-Rated Plans

AZ: AZ529, Arizona's Education Savings Plan

CA: ScholarShare College Savings Plan

MI: Michigan Education Savings Program

MN: Minnesota College Savings Plan

NY: New York's 529 Program (Direct)

And more across CT, DE, GA, MD, ME, NH, OH, VA

These plans stand out for low costs, strong investment options, and user-friendly features.

Should You Go Out of State?

You should consider an out-of-state plan if:

Your state offers no tax benefits or has no income tax

You live in a tax parity state

You contribute modest amounts where state tax savings are minimal

Your in-state plan has high fees or poor performance

Final Thougts

529 plans remain one of the best ways to save for education, but choosing the right one depends on more than investment performance. State tax treatment can make a meaningful difference, particularly for high contributors or families with multiple children. Take the time to understand your options, compare plans, and make a decision that aligns with both your financial goals and tax situation.

The information provided herein is intended solely for general informational purposes and should not be interpreted as personalized investment advice or an individualized recommendation. Investment strategies discussed may not be appropriate for every investor. Each individual should carefully evaluate any strategy in light of their unique financial situation before making investment decisions.

All opinions expressed are subject to change without notice in reaction to shifting market conditions. While data presented may come from third-party sources believed to be reliable, Mietzner Wealth Management cannot guarantee its accuracy, completeness, or reliability.

Any examples provided are purely illustrative and do not represent expected outcomes or guaranteed results.

This content is general in nature and is not intended to provide specific legal, tax, or investment advice. Tax regulations may change, potentially with retroactive effect. For advice tailored to your individual circumstances, consult with qualified professionals such as a CPA, financial planner, or investment advisor before acting on any of the information provided.

Please consult your tax advisor to determine the deductibility of interest payments on a home equity line of credit based on your personal tax situation.

All investments involve risk, including the potential loss of principal.

Get in touch

Address

800 W El Camino Real, Ste 180

Mountain View, CA 94040

Contacts

408-786-5566

contact@mietznerwm.com

© 2025. All rights reserved.

Investment Advisory Services offered through Mietzner Wealth Management, LLC, a California Registered Investment Advisor.